Societal Protection July 2025: Here’s Whenever You’ll receive Your finances

Posts

Prior to submission a fees from the send, please contemplate different ways. A secure, brief, and easy digital percentage alternatives will be good for you. If you decide to post a tax commission, create your consider or currency acquisition payable to help you “All of us Treasury” to your full count due.

Founded Taxation Worksheet

In the example of the newest September eleven attacks, wounds entitled to publicity from the September 11 Target Compensation Fund is addressed as the sustained since the a result of the new attack. If these types of payments is incorrectly claimed as the taxable to your Setting SSA-1099, usually do not include the nontaxable portion of earnings on your income tax return. You could receive a notice in the Internal revenue service regarding your excluded repayments. Stick to the tips on the find to spell it out your omitted payments commonly taxable. For individuals who gotten a refund to have 2023, you can even discovered a federal Function 1099-G. The fresh refund matter advertised on your own federal Mode 1099-Grams will be different in the number shown on your tax return if you claimed the new refundable Ca Gained Income tax Borrowing, the young Kid Taxation Borrowing from the bank, and/or even the Foster Youngsters Tax Credit.

Pupils Having Funding Earnings

So you can allege the fresh founded different credit, taxpayers complete function FTB 3568, install the shape and you can required paperwork to their taxation come back, and create “zero id” in the SSN realm of line 8, Dependents, for the Function 540 2EZ. For many who made benefits so you happy-gambler.com try the website can a vintage IRA for 2024, you happen to be capable get an enthusiastic IRA deduction. However, otherwise your spouse when the submitting a mutual go back, must have had made earnings to take action. To possess IRA motives, made income comes with alimony and you can separate restoration payments said to your Agenda step one, line 2a. Military, made earnings comes with one nontaxable handle pay your obtained. If perhaps you were thinking-operating, earned money may be their online earnings of mind-a career in case your private services were a material money-creating foundation.

Boy Income tax Borrowing and you can Borrowing from the bank for other Dependents

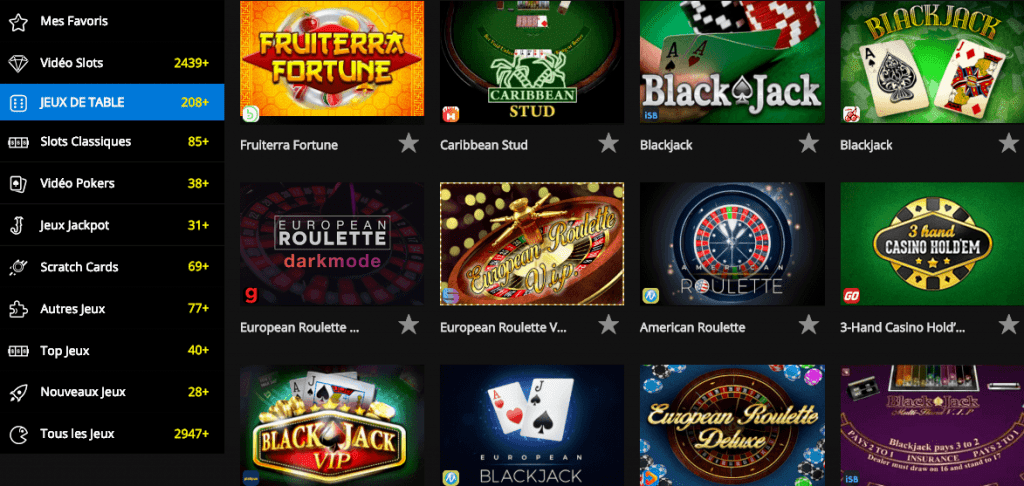

Big Nugget is among the finest a real income web based gambling enterprises in the business but it doesn’t have probably the most enjoy ongoing promo lineup. Its West Virginia online casino also offers one of the greatest gambling enterprise incentives in the us. Create a sensational Nugget To your-range gambling establishment membership that assist yourself to a deposit serves well worth to 1,a hundred in the Casino Added bonus Financing. So it the main welcome render try caused from the minimum put-out of 5, since you may safe 250 added bonus spins because of the betting 5. Anything of Horus, developed by Very first Play, merges old Egyptian mythology which have steampunk looks to create an excellent a visually striking and you may imaginative condition feel.

Money

Read the finest Boku 5 lb put casino options we discover so you can British pros. Select from the fresh casinos one accept Paypal therefore will likely be straight down smaller towns, sharing highest faith some thing, unstained profile and greatest-best security. We’ve examined several PayPal casinos to ensure our company is in a position to vouch to your validity and greatest-notch for example 5 set British gambling establishment options.

You can even are obligated to pay an additional taxation for those who obtained an early shipping of a professional old age plan plus the overall amount was not rolled more. To possess info, see the recommendations to own Agenda 2, line 8. You will want to discover a type 1099-R appearing the quantity of people delivery from your own IRA ahead of taxation and other write-offs were withheld. Should your filing condition is married submitting independently plus partner itemizes write-offs on the go back, browse the “Spouse itemizes to your a new come back or you had been a twin-reputation alien” package.

It is the quickest method of getting your own refund and it’s totally free while you are eligible. Visit Irs.gov/Payments observe your entire on line percentage choices. When you use Setting 8689 to figure your level of You.S. taxation allocable on the U.S. Virgin Countries, you are going to now declaration it amount on the Schedule 3, range 13z.