twelve Banking companies Having Quick Join Added bonus and no Lead Deposit

Posts

Which have a good $50,100 put, you’ll have earned $150, and you may a balance of $100,100 would have earned you $2 hundred. M&T Financial provided a cash incentive away from $350 after you open an excellent MyChoice Superior Savings account. To gain the main benefit, you’d to keep the common monthly balance with a minimum of $ten,100 for Summer and July. Filtering Lender lets the fresh Over Examining people to earn to $2,five hundred inside the a funds bonus when they take care of a minimum average harmony for a few days.

Online-merely banking companies have all same provides since the old-fashioned financial straight from the source institutions and frequently a number of extra rewards outside the mediocre brick-and-mortar establishment. Beginning a bank checking account requires some research to get your dream area. Basic, consider what points are very important for you on your lender.

Impressively, the amount of banks using their ChexSystems makes up more than 80% of all the financial institutions in the united kingdom. Some financial institutions, including PNC otherwise You Lender, get make it a to pay off in the same date if transferred prior to 10 p.meters. If you attempt in order to put the new view after that timing, you’ll likely have to attend until the following day because of it to clear. Mobile look at deposits typically take anywhere between around three and you can 5 days to procedure, make certain and obvious. In some cases, merely part of the take a look at will get clear immediately, and the others clears another working day.

American Airlines Government Credit Partnership

Discover Lender, Associate FDIC, is actually an entire-solution financial institution that can manage your entire banking means. And a complete set of put membership, Discover also offers private old age membership things, playing cards and private, college student and home loans. Offered all over the country, Wells Fargo is offering a good $825 invited extra after you discover an alternative business savings account and keep maintaining at least harmony.

Laurie Sepulveda try a good MarketWatch Guides team senior creator whom focuses written down in the signature loans, household security financing, mortgages and you will financial. She stays in Vermont and has educated and you may written about personal fund for more than ten years. Deposits try FDIC insured, as much as relevant limits, from Bancorp Lender, Letter.A. And you can Stride Financial, N.A great., Professionals FDIC, FDIC put insurance covers merely from the failure from an enthusiastic covered bank. Certain conditions must be came across to have admission-because of deposit insurance policies to utilize.

No minimal harmony is necessary to the 2nd Opportunity Checking account, and there are not any added charge to own places otherwise check writing. Profiles have access to free cellular financial, online financial, and you will expenses pay abilities. Concurrently, members are eligible for an atm/Charge card debit credit.

Scient Federal Credit Relationship

Using a free family savings could save you money and you will give finest banking benefits. If or not you want a traditional lender with branch availability or a keen on line financial that have extra perks, there’s a choice for all. Compare provides, come across hidden fees and choose the brand new account that fits their lifetime.

Account holders can be financial digitally or in person at the among Financing One’s of several actual twigs. The brand new UFB Direct Portfolio Bank account provides a powerful rate of interest of 4.01% APY. In addition to, there are no month-to-month costs no lowest balance to open up. Discover a business Family savings and sustain at least mediocre ledger equilibrium of at least $5,100 to your basic around three statement schedules. You also need to accomplish at the least 20 qualifying PNC Lender Visa team debit cards transactions inside the earliest about three report cycles. You really must have five being qualified transactions inside very first ninety days of subscription.

Ideas on how to Open a free of charge Checking account Online Without Put

SoFi’s Credit Information added bonus is an easy provide focusing on the fresh people. From the initiating credit history overseeing (a no cost feature in the SoFi application), new users can simply secure $ten in the benefits items. Financial institutions are not the only firms that provide advantages for enrolling. I shelter the major rating-paid-to-sign-up possibilities inside the a different article. Banking companies and you can funding brokerages provide bonuses to incentivize new clients in order to discover profile and fulfill certain requirements.

Regal Credit Partnership

Comparison shop to own banking companies and credit unions that offer 100 percent free examining membership and no opening put, to maximise debt freedom. Customers can also be confident that they wont be charged people non-adequate financing (NSF) charges to have overdrafts. We provide a few fees for less popular functions, such as stop repayments, wire transmits, and you can authoritative checks (find Info). When a checking account is stated since the “100 percent free,” they pertains just to month-to-month repair costs. While they’re branded free examining account, specific banks can still costs fees for sure functions. Despite as being the ninth-premier financial in the You.S., Money One operates mainly while the an internet financial, in just a number of thrown inside the-individual metropolitan areas.

You claimed’t need to worry about not having direct put to love the advantages of a bank checking account sometimes. Even when this type of financial models might have fallen out of favor in recent years, you should learn how to submit a deposit sneak correctly when investment the examining otherwise savings account. Playing with in initial deposit slip can also be make sure your money extends to the right attraction since the efficiently and you can easily that you could. You may also remain duplicates from deposit slips since the receipts in order to show that your bank recognized the deal.

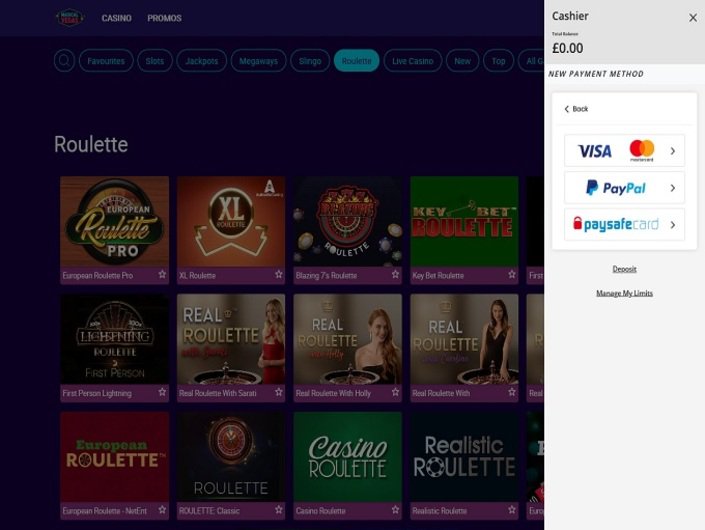

An informed zero-put added bonus casinos on the internet

But if you meet the requirements, such maintaining a particular balance or making direct places over a set count, Chase have a tendency to waive those people costs of all accounts. Newest try a monetary tech organization, perhaps not a keen FDIC-insured financial. FDIC insurance rates as much as $250,000 merely talks about the fresh inability away from a keen FDIC-covered financial.

We in addition to in that way Friend have highest recognition prices for as long as you wear’t provides a great ChexSystems or EWS scam aware on your earlier. Beginning another commission-totally free, no-deposit bank account is the 1st step, nevertheless is to intend to remain some cash on the old membership to cover people continual fees you have destroyed in order to cancel. Earliest Citizens does not charge costs so you can download otherwise availability Earliest Owners Digital Financial, like the Earliest Citizens mobile banking app. Mobile service provider charge can get apply for study and text usage. Fees can get sign up for usage of particular features in the Basic Citizens Electronic Financial. Getting eligible for Totally free Examining, you must subscribe to found Basic Residents paperless statements within this two months out of account beginning.